Enovado’s US Market Series supports European companies contemplating investments in the US market. This edition focuses on the E-Mobility sector, and is meant to serve as a guideline to assess the market landscape and dynamics as well as attractive locations and incentive opportunities such as the present state and evolving facets of the Inflation Reduction Act.

Highlights – E-Mobility | Inflation Reduction Act (Overview)

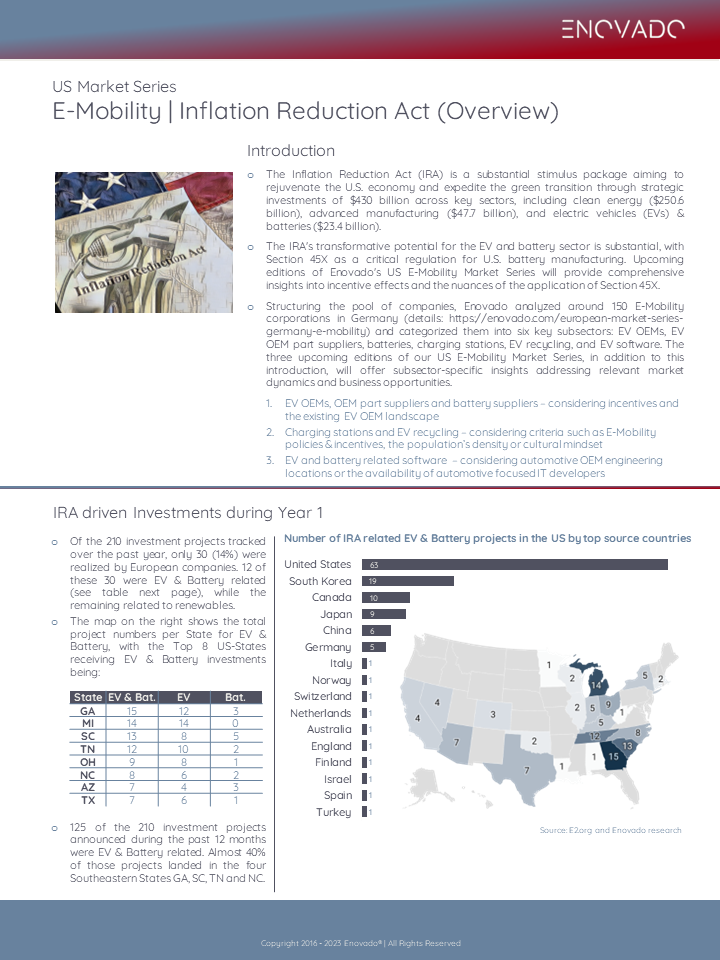

o Despite contrary indications in recent news, European investments constitute a mere 14% of the 210 investments projects attracted during the first 12 months following the IRA’s introduction. Narrowing the scope to EV & Batteries yields a mere 12 projects, predominantly realized by German companies.

o European EV & Battery investors, in many cases, seem to follow their peers or European OEMs and Tier1’s. Notably, Southeastern States such as GA, SC, TN or NC attract the bulk of their investments, while the traditional Automotive States of MI, OH, IN or KY appeal mostly to North American investors.

o International investors that prefer to locate at a distance from the mainstream, e.g. to compete less on talent, might also consider States such as AZ, TX, or WI.

About Enovado’s European Market Series

o Enovado’s US Market Series supports European companies contemplating investments in the US market. It is meant to serve as a guideline to assess the market landscape and dynamics, strategic locations, and incentive opportunities, particularly in regards to the present state and evolving facets of the IRA.

o With extensive involvement with US State and regional economic development organizations (EDOs) as well as ongoing dialogue with European automotive suppliers contemplating a North American market entry, Enovado leverages its first-hand insights to add value to the Market Series.

o We intend to publish all three subsequent editions of the US E-Mobility Market Series by the end of 2023.

Download full report (pdf) here: US – E-Mobility | IRA (Overview)